WorthWhile Ventures Campuses

Worthwhile Ventures’ EconomyTech Campuses are profitable Mega-Project Funds that build sustainable economies, export-diversity and autonomous self-reliance.

Check out our new homepage and tours at http://worthwhileinc.com

Manual at first, these neighbourhoods transition responsibly to cost a fraction of today’s cost-of-living for food, housing, manufacturing – sustaining pension values and building many more benefits. Connected, Renewable AI Automations ensure Good Lives while economies save trillions in imports and energy spending annually.

Sixteen initial Worthwhile PLCs are CSQ-Certified, Life-Cycle-Managed, and profitable multi-billion-dollar national companies that create 600 jobs Year-1. In time, these scalable EconomyTech Campuses do the heavy lifting of any GDP’s largest markets while attracting trillions of dollars in capitalization gains, profit, economic gains, and Intellectual Property. Worthwhile Campus support Good Lives and permit an autonomous global infrastructure for Maslow’s Hierarchy of Needs

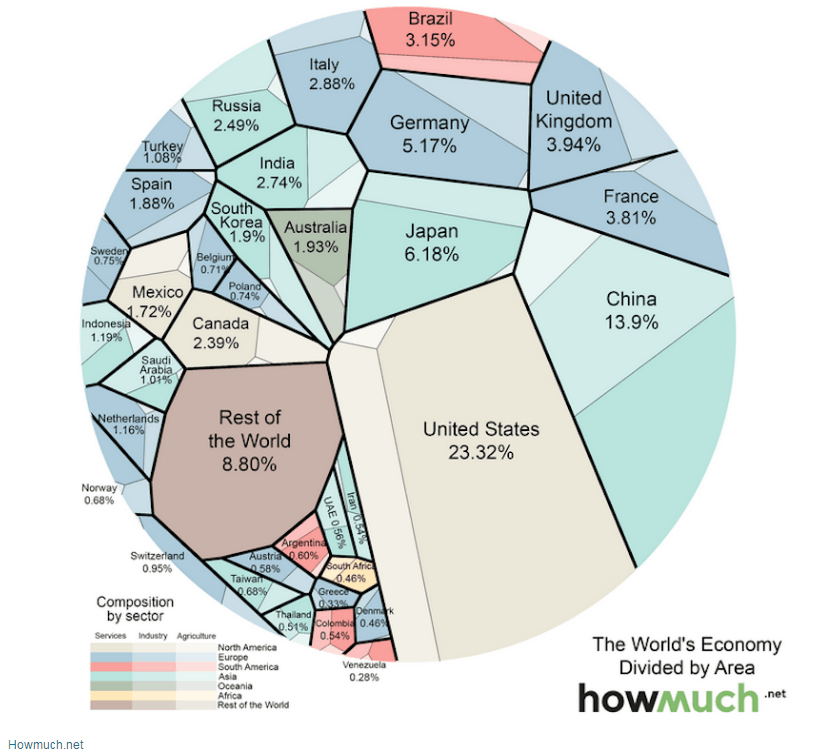

Huge Market Sizes

|

|

WorthWhile Funds

WorthWhile Impact Funds offer pragmatic, sustainably profitable, Economy-Boosting Private & Public Equity investments globally in Emerging Markets and established countries alike

|

|

Scalability

Our Teams

Executive Advisory Board Fellowship Program

Global Impact

Vision 2030 Oil-free Economy Goals and United Nations Sustainable Development Goals (SGDs) are met by development that advances economies by Big Push Economic Theory and Government Policies proven to permit Jobs and Industries to Transition Responsibly

Strategic Partners & Economic Development Joint Ventures

Worthwhile Ventures enlist Academic, Research, Governments and Industry Leading Companies as Strategic Partners to whom we provide access to the latest technologies, advisory and premium technical support

CSQ-Certification & EconomyTech

Investors who seek to ensure Sustainable Impact chose CSQ-Certified EconomyTech Companies that build Economic Injectors in scalable self-sufficiency, abundance, lower cost-of-living, Good Lives and sustainable prosperous economies. Click here for more …

Investors who seek to ensure Sustainable Impact chose CSQ-Certified EconomyTech Companies that build Economic Injectors in scalable self-sufficiency, abundance, lower cost-of-living, Good Lives and sustainable prosperous economies. Click here for more …

Why Worthwhile?

Aristotle called the American Dream a “Good Life” 2500-years ago. A “Meaningful Life”, he explained, was one spent building worthwhile projects by a right plan that brought about a sustainable society. Worthwhile communities have all the basic needs of a Good Life – like abundant food, shelter, education, energy, opportunity, transportation, prosperity and security.

Each Worthwhile Global Impact Funds finances sixteen EconomyTech companies. EconomyTech companies are Advanced Industries that build a Right Plan in Business, Engineering, Finance, and Economics which ensure self-sufficient communities and economies sustainably. Our selected EconomyTech companies target 70% of a GDP’s commodity marketplace, build 300 hi-tech jobs – plus contract staff, and share resources across all 16+ companies (PLCs) as needed to reduce a typical Robotics Company Return-on-Investment (ROI) – from a typical 5-year time-frame, down to just 20-months.

Individual Worthwhile Ventures Companies create flexible Private Equity offerings with 20% annual average sustainable gains and a 20-month ROI (by our Realistic Plan – which is based on solid 20-30%-profit operating revenues and a Smart Revenue Ramp-up SRR Risk Mitigation Strategy). The milestone of >$20M EBITDA is reached in early Year-2 and Maximum Cumulative Cash flow is not required to exceed $66M.

Performance estimates assume that none of our most successful hi-tech companies will reach IPO (Initial Public Offerings) before Year-5, however, this might be a pessimistic estimate as the Robotic and Autonomous Delivery Private Equity and IPO marketplaces are trending and our strategic Patents and IP may attract public interest.

Normal capitalization planning permits us to miss cash-flow targets almost four-times without impacting our 20% annual Gains estimates. It should also be noted that i) our management team have a track record that doesn’t miss targets in $2 billion annual technology delivery organizations over 20-years; and ii) none of our industry sectors have failed to produce multi-billion-dollar valuation-companies. If any one of Worthwhile Venture Fund’s sixteen companies reach a two-billion-dollar capitalization within five years, our 20% annual gains estimate multiplies 3-times.

Alan Turing’s 1943 Universal Machine began a 70-year era of automation that is as promising as it has been disruptive. G7 Governments appear universally uncertain about how to support citizens through a steady barrage of job-losses at the same time that the benefits of computer automation are undeniable.

Strategic Planning discussions often conclude that if we do not “shoot where the duck will fly”, and develop self-sustaining automation today, then we will find ourselves purchasing automated imports from China, Germany, and others within five years – and we see this already today.

No other country will spend more for our lower-quality exports – until the failing of our exports have a devastating, destabilizing economic impact similar to the USSR’s 1986 Economic Collapse for this same reason. In a global monetary system, countries must be self-sufficient and they must also monetize their economy by creating export wealth. Failing both risks economic collapse.

To solve these critical problems, CSQ Research – our guiding Think-Tank, compared the production, debt and trade stats of 180 countries and found that 72% are in a collapse-trending today (a “collapse-trending” indicates debt and trade deficits). Analyzing the policies and economies of the other 28% of “Advancing” nations, is a study in sustainable, empirically proven-successful policy – scientifically speaking. Here is what we learned.

Countries with high ExCaps very rarely have economies in a collapse trending – and people live well. The Netherlands’ ExCap is $33,600, Canada is $13,300, and the US is $5,100. The US and Canada are Collapse-trending; Holland is Advancing. When corrected to Holland’s ExCap levels, Canadians would earn $630 billion in new exports annually – that’s a 250% increase in today’s exports. The U.S. side-steps $8 trillion annually by this calculation, and the U.K. loses $1.5 trillion. China’s Economy is Advancing with low ExCap, but their brilliant, Herculean 30-year plan to lift 1.3 billion people out of the stone-age, still showcases a standard-of-living for the average citizen that would be a steep step-backward for G7 nations; low-ExCap, low-opportunity, plus high-inequity was the pervasive economy of a 1000-year medieval dark-age. (Find the stats that we used at https://csq1.org/forums/topic/middle-class-for-power-49-percent-for-prosperity/ and https://csq1.org/forums/topic/the-business-case-for-guaranteed-incomes/).

The discussion casts into sharp relief the very high cost of inequity-levels that prevent a highly productive population. For Canada, $630 billion in new country-wide export revenues makes a compelling Business Case for the 1/4th lower-cost social supports, and automations that support a Good Life, at a fraction of the cost, and new export wealth while we sleep.

With community automations in basic needs of food, housing, energy, basic goods, Citizens are self-sufficient; they can live good lives that will be little disrupted by economic ups and downs. Automating communities reduces the need for Import spending, it creates exports that citizens can sell, and this approach also enables incomes to be sustained away from overcrowded cities and housing-bubbles; this prevents inflation, which protects pension values, while reducing inequity; and this strengthens democracy’s sustainably too.

Without these automations, and supporting policies, Canada’s Economy is not self-sufficient, so it will need more Imports as it struggles to sell its exports in an increasingly higher-quality, lower-cost international marketplace. As Trade Deficits and Collapse-trendings accelerate, we have few options.

Worthwhile PLCs build these automated Export Economic Injectors, and cost-of-living & import-reducing Community Automations specifically. Our Automated Exports, similar to Germany-owned VW, build robots (automated assembly lines) that build robots (autonomous cars, autonomous lumber farms, etc.) that create high-quality exports and new wealth (http://www.zerohedge.com/news/2015-09-22/why-volkswagen-systematically-important-germany-and-europe).

Our automations adhere to #WPProjects’ list of the 250 technologies needed to create automated communities (see https://csq1.org/world-peace-transition-projects-faq/) and Transition Economics’ TEMature Policy (https://csq1.org/transition-economics-maturity-model/#TEMat); a list of the Economic Policy Injectors consistently employed by “Advancing” nations. Together, this is a Strategic Right Plan (another term of Aristotle’s) for reliably advancing economies, incomes, and spending-power – while we sleep.

Worthwhile Industries build self-sufficient communities profitably with a sustainable approach that mitigates risk by targeting revenue in low-barrier-to-entry very-large markets. Automation is neither about denying we humans an income nor denying a dream job of delivering flowers; rather, sustainable social supports and automation work together to prevent entire lives being spent twisting light-bulbs into assembly-line refrigerators. This individuals not twisting light bulbs are now able to build productive exports, to restore poetry, music, arts, culinary arts, life-sciences research, exploration, discovery, and restoring humanity and freedoms – to our society. Ask a 20-year office-worker or truck-driver “Are you ready for a change?“, eight times out of ten, you are going to hear “Of course”.

Strategic Public Investment in interconnected Renewable Automations is a shift in thinking as beneficial as was Henry Ford’s assembly line. It’s a shift that supports worthwhile and profitable industry at the same time that it also harvests the trillions of dollars in economic prosperity left on the table when our technology Investments do not inter-operate to support a Good Life. When Investment Markets prosper at the same time that national Debt, Deficits, Unemployment, Incomes and Trade Deficits are corrected, only then can they be considered sustainable – and worthwhile.