- This topic has 0 replies, 1 voice, and was last updated 8 years ago by

etilley.

-

AuthorPosts

-

March 25, 2016 at 2:40 am #3993

etilley

KeymasterEconomic Controls for Housing Bubbles

Is housing shelter? Or is housing an investment marketplace?

Any television News Report is going to confuse a local citizen who is living inside one of these bubbles – quite a bit. The notion that foreign investment is a good thing, regardless of whether it makes shelter unattainable for young families or not, is about the only way that housing is reported in the finance news today. By my recollection, Finance-gains benefit a handful of individuals, where Society-wide-gains benefit everyone.

Who should win this discussion – Finance? Or Families?

Society-wide-gains are essentially the definition of Freedom, of Opportunity, and the American Dream that our early Baby-Boomer Generation enjoyed. My friend’s dad is 73 today; as a youngster he was able to easily buy a five-acre lot of waterfront land in downtown Burlington, Ontario – when he was 17 – from the proceeds of his summer student job. These opportunities and freedoms are not available to today’s teenagers – nor anyone else.

Economic Controls protect housing costs from soaring so that young people can purchase a home with a high probability of paying off their mortgage. In 1982, houses cost $32,000 with interest rates of 22% at a maximum. As soon as interest rates dropped to 12%, houses skyrocketed to $90,000. The same house climbed to $500,000 as rates dropped to 2%, so clearly falling interest rates are a bad thing. We probably hit the point when mortgages became usury at around 12% and we have stayed in a Usury state ever since.

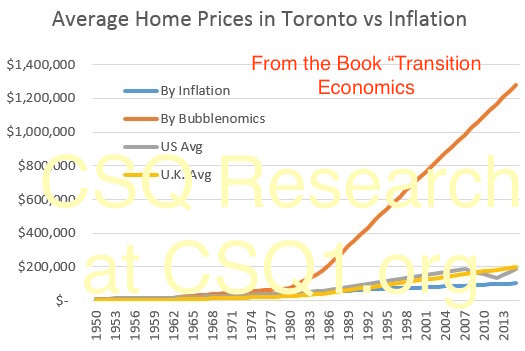

Housing in major hiring/income centers is at thirteen-times-inflation (13 x) since 1987 due to an absence of responsible management controls. Usury in these bubbles is rife as desperate homebuyers are forced into agreeing to take on loans that they will seldom be able to repay.

Housing in major hiring/income centers is at thirteen-times-inflation (13 x) since 1987 due to an absence of responsible management controls. Usury in these bubbles is rife as desperate homebuyers are forced into agreeing to take on loans that they will seldom be able to repay.“Usury” is the practice of extending loans that can never be repaid; the practise is illegal in most countries – and most social leaders would agree that this is an immoral practice as well. Our dictionaries have altered Usury’s definition to focus on unreasonably high interest rates only, but when essential housing costs within bubbles are 13-times the rate of inflation and inventories (supply) are kept scarce ongoing and artificially, Usury can happen at interest rates of just 2% or 3%. We see this same event in China’s vast ghost cities where costs are kept dramatically higher than market demand – artificially and as a matter of policy as well. Citizens can often live in affordable slums that are unfit for children to live in, directly adjacent to these housing developments.

The Canadian Mortgage Insurance people at CMHC have very recently started to realize this problem and just this week raised requirements insufficiently in response. Inviting immigrants to settle in these areas – as they have preferred, exaggerates these scarcities and bubbles.

In the chart above, the Toronto Real-Estate bubble in Red is compared to the housing prices in non-bubble markets and the Inflation line over the same 65-year period (over the last economic K-Wave cycle).

Rental housing owners – once called slum-lords – are revered now as financial geniuses that collect enormous profits when tenants are unable to afford to buy homes of their own. Housing Bubbles create an enormous tax on breathing basically, and the individual who benefit do so with too-few rent increase and eviction controls. Our recent high divorce and unemployment rates have ensured that new rents could soar by up to 100% in just the last three years.

Housing prices become unsustainable without controls – beginning with bidding wars between investors, immigrants, and new and existing homeowners. Today, our housing policies ensure that highest-bidder-wins irrespective of all other factors. Rent controls in New York City and “En Viager” contracts in Paris’ (American Press, 1995), protect seniors from these market bubbles and Cost of Living up-swings.

Real Estate in some city centers and premium locations (beside water, on ravines, lots with a view, nicer neighbourhoods, etc.) are more desirable than others too. Creating region-by-region price controls, or a cap on annual price increases, are necessary if children are going to be able to move close to their parents when they begin their families in time.

Other solutions could include restrictions on who can offer to buy property so that 1) locals, 2) new home buyers, 3) previous homebuyers, 4) local investors – can bid only based on a ceiling price. If bidders make no offer, then bids are opened to refugees, immigrants, foreign investors, and so on. In this way, the cost of houses are protected from bubbles, and young people have a chance to begin productive lives in the neighbourhoods in which they grew up.

A discussion of Housing Controls, therefore, must mitigate several risks:

- Beginning in late K-Wave Summer, Interest Rates should probably be prevented from running up, but if they do as a normal protection against inflation, they cannot then drop below a percentage that encourages small investors from driving up the housing market. Perhaps this is a good reason to cap interest rates as you consider another option – a per-square-foot Price Increase Cap that would prevent the rapid increase of house prices. I have never seen a cap like either, which probably explains current worldwide trends and a resulting phenomenon called Housing Bubblenomics (Aldrick, 2015).

In his Telegraph article from November 2015, Philip Aldrick notes, “What’s remarkable about this bubble is it has inflated without a recovery. Markets have become completely detached from economic reality.” - For First-time Homeowners – lower-down payments, low debt-to-income ratios, low unemployment, and high minimum wage are required to service a mortgage. Perhaps lower interest rates are offset by higher investor rates.

- Existing Owners – Higher down-payments for existing owners with preference to owners that grew up in or live in the area presently.

- Merit – From our discussion in Chapter 19, perhaps Performance & Merit should be factored into which bids can be accepted and which cannot as well.

- Investment Properties, higher-down-payment percentages than owners.

- Finally, Offshore Investment – Should housing be considered an investment before all have shelter? If you see from my observations above that this question should be answered “No” as I did, then you might also agree that offshore investment in private homes should be discouraged. Foreign investment brings the Real Estate Bubbles and problems of other communities to your country. Perhaps these bidders could be permitted to compete only if local bidders are not available at mandated pricing. In this way housing costs stay low and new home construction is encouraged.

- Switch between Land Grant and Ownership models, as explained the next few sub-topics of World Peace – The Transition, to protect society from Usury.

- Monitoring is required to ensure rental properties are not soaring in monthly costs.

Clearly, our present systems are not brilliant. They encourage Bubblenomics and prevent our young adults from raising families of their own – in their own hometown. Current rules and systems are flawed, so do not blindly protect them but rather enact corrections as needed. Nothing is too big to fail and nothing is too important that it cannot be adjusted in pursuit of Human Rights and a Good Life.

Mortgage borrowing is stressful, it reduces our quality of life and longevity, and as with most non-business generating financial services, it advances society relatively little. It makes properties exponentially more expensive, our children cannot begin lives in their hometown, and it encourages purchasers to live beyond their means and reasonable debt loads.

Read more about how to resolve Housing Bubbles, in the book Transition Economics …

World Peace is just a Project !

Let’s get building again ! Learn more at csq1.org/mag and Get the Book here!

Share a tweet with your friends:

Worldville is the Global Automated Society. One automation project per country https://t.co/laOTezYHZL #wpprojects pic.twitter.com/Gx3jivi1h8

— Edward Tilley (@TilleyEdward) December 29, 2015

- Beginning in late K-Wave Summer, Interest Rates should probably be prevented from running up, but if they do as a normal protection against inflation, they cannot then drop below a percentage that encourages small investors from driving up the housing market. Perhaps this is a good reason to cap interest rates as you consider another option – a per-square-foot Price Increase Cap that would prevent the rapid increase of house prices. I have never seen a cap like either, which probably explains current worldwide trends and a resulting phenomenon called Housing Bubblenomics (Aldrick, 2015).

-

AuthorPosts

- You must be logged in to reply to this topic.